Fintech and data architecture are closely intertwined, as data architecture forms the foundation for the successful implementation and operation of fintech solutions. Data architecture plays a crucial role in the fintech industry, where large volumes of financial data are generated, processed, and analyzed on a regular basis. Fintech companies leverage data architecture to effectively manage and utilize financial information for various purposes such as risk assessment, fraud detection, customer insights, and decision-making. Data architecture in fintech is primarily concerned with managing, storing, processing, and analysing financial data. A modern tech stack typically involves at least a frontend and backend but relatively quickly also grows to include a data platform. This typically grows out of the need for ad-hoc analysis and reporting. Data architecture in fintech typically involves the following components:

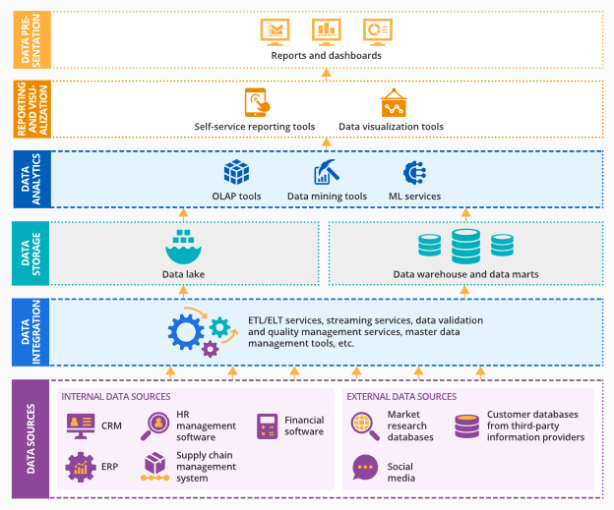

Data Sources: Fintech companies gather data from various sources such as banking transactions, credit card purchases, investment portfolios, market data, social media, and more. These diverse data sources contribute to a comprehensive view of customers’ financial activities.

Data Integration: Integrating data from different sources is a critical aspect of data architecture in fintech. It involves consolidating and harmonizing data to create a unified view of financial information. Data integration enables accurate and efficient analysis by eliminating data silos and providing a holistic perspective.

Data Storage: Fintech companies need robust data storage systems to store and manage large volumes of financial data. Traditional relational databases are commonly used, but with the advent of big data technologies, NoSQL databases, data lakes, and cloud storage platforms are also employed to handle the scalability and flexibility requirements.

Data Processing: Fintech companies employ data processing techniques such as data transformation, cleansing, aggregation, and enrichment to ensure the data is accurate, reliable, and suitable for analysis. This step often involves data pipelines and ETL (Extract, Transform, Load) processes to move and process data efficiently.

Data Analytics: Fintech companies rely on data analytics to derive valuable insights from financial data. Advanced analytics techniques such as machine learning, artificial intelligence, and predictive modeling are employed to detect patterns, identify anomalies, make predictions, and generate actionable recommendations.

Data-driven Decision Making: Fintech companies heavily rely on data to make informed business decisions. Data architecture enables the collection, integration, and storage of relevant financial data, allowing fintech companies to analyze trends, patterns, and customer behavior to drive strategic decision-making.

Real-time Data Processing: Many fintech applications require real-time data processing capabilities to deliver up-to-date financial information and enable instant transactions. Data architecture plays a crucial role in designing and implementing systems that can handle real-time data streams, process them efficiently, and provide timely insights and responses.

Personalized Customer Experiences: Fintech companies often aim to provide personalized services tailored to individual customer needs. Data architecture allows for the collection and analysis of customer data, enabling fintech platforms to deliver personalized recommendations, targeted marketing campaigns, and customized financial products.

Data Governance and Security: Fintech companies deal with sensitive financial information, making data governance and security critical. Data architecture includes implementing measures to ensure data privacy, comply with regulations (e.g., GDPR, PCI-DSS), establish data quality standards, and enforce access controls to protect against unauthorized access and data breaches.

Scalability and Performance: Fintech companies must design data architecture that can scale to handle increasing data volumes and support real-time processing requirements. Technologies like distributed computing, parallel processing, and cloud infrastructure are often used to achieve scalability and high-performance data processing.

Data architecture is a critical component of fintech, enabling efficient data management, processing, and analysis. It empowers fintech companies to deliver innovative financial solutions, enhance customer experiences, mitigate risks, and comply with regulatory requirements. A well-designed data architecture forms the backbone of successful fintech operations and enables fintech companies to harness the power of data, improve operational efficiency, enhance customer experiences, and gain a competitive edge in the rapidly evolving financial industry.